Are Robust Financials Driving The Recent Rally In U.S. Physical Therapy, Inc.’s (NYSE:USPH) Stock?

U.S. Actual physical Therapy’s (NYSE:USPH) stock is up by a sizeable 22{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} about the past thirty day period. Supplied that the sector benefits solid financials in the prolonged-phrase, we question if that is the scenario in this occasion. Particularly, we will be spending notice to U.S. Actual physical Therapy’s ROE these days.

Return on fairness or ROE is a important measure applied to evaluate how efficiently a firm’s management is making use of the firm’s capital. In other phrases, it is a profitability ratio which steps the rate of return on the money supplied by the firm’s shareholders.

Perspective our newest evaluation for U.S. Physical Therapy

How Do You Work out Return On Fairness?

ROE can be calculated by making use of the method:

Return on Fairness = Web Revenue (from continuing operations) ÷ Shareholders’ Fairness

So, based mostly on the over components, the ROE for U.S. Actual physical Treatment is:

12{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} = US$55m ÷ US$467m (Dependent on the trailing twelve months to September 2022).

The ‘return’ is the income the small business earned more than the final 12 months. That signifies that for each $1 worth of shareholders’ fairness, the company created $.12 in income.

Why Is ROE Crucial For Earnings Growth?

So significantly, we have discovered that ROE steps how proficiently a company is creating its revenue. Based mostly on how considerably of its earnings the enterprise chooses to reinvest or “retain”, we are then in a position to examine a company’s upcoming capability to produce income. Assuming anything else remains unchanged, the bigger the ROE and income retention, the bigger the progress charge of a company in comparison to companies that will not automatically bear these characteristics.

U.S. Physical Therapy’s Earnings Progress And 12{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} ROE

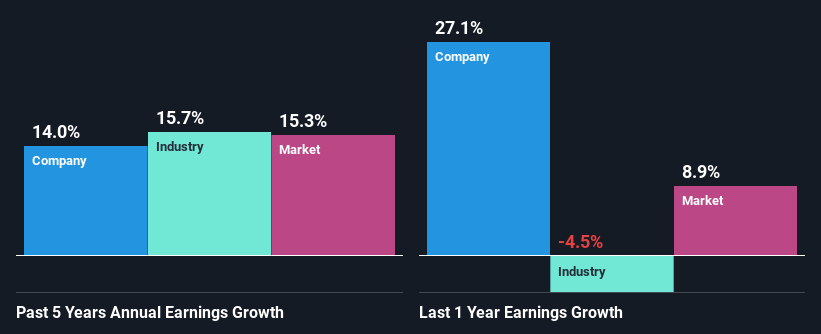

At to start with look, U.S. Bodily Treatment appears to have a first rate ROE. Even when compared to the business typical of 13{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} the company’s ROE appears to be very first rate. This surely adds some context to U.S. Bodily Therapy’s moderate 14{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} web profits growth noticed around the previous five several years.

Future, on comparing U.S. Bodily Therapy’s internet cash flow expansion with the field, we found that the company’s reported progress is very similar to the marketplace ordinary advancement level of 16{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} in the exact time period.

The basis for attaching benefit to a enterprise is, to a fantastic extent, tied to its earnings development. The trader should try out to create if the envisioned advancement or decline in earnings, whichever the case may possibly be, is priced in. By carrying out so, they will have an concept if the stock is headed into distinct blue waters or if swampy waters await. If you are wanting to know about U.S. Physical Therapy’s’s valuation, look at out this gauge of its rate-to-earnings ratio, as in contrast to its industry.

Is U.S. Physical Therapy Working with Its Retained Earnings Efficiently?

With a three-year median payout ratio of 46{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} (implying that the company retains 54{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} of its profits), it looks that U.S. Actual physical Treatment is reinvesting effectively in a way that it sees respectable volume development in its earnings and pays a dividend that is properly included.

Aside from, U.S. Bodily Remedy has been spending dividends for at minimum ten several years or a lot more. This demonstrates that the business is dedicated to sharing earnings with its shareholders.

Summary

On the full, we really feel that U.S. Physical Therapy’s performance has been pretty excellent. Especially, we like that the corporation is reinvesting greatly into its company, and at a superior level of return. Unsurprisingly, this has led to an outstanding earnings progress. That being so, a review of the most current analyst forecasts exhibit that the company is anticipated to see a slowdown in its long run earnings progress. To know extra about the firm’s long run earnings progress forecasts acquire a glimpse at this cost-free report on analyst forecasts for the corporation to locate out additional.

What are the challenges and alternatives for U.S. Physical Therapy?

U.S. Bodily Remedy, Inc., by its subsidiaries, operates outpatient physical treatment clinics that supply pre-and article-operative treatment and therapy for orthopedic-associated diseases, athletics-linked accidents, preventative treatment, rehabilitation of hurt staff, and neurological-similar accidents.

See Full Investigation

Benefits

-

Earnings are forecast to grow 4.05{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} for every year

-

Earnings grew by 27.1{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} about the previous yr

Risks

-

Important insider selling more than the earlier 3 months

Perspective all Pitfalls and Benefits

Have suggestions on this short article? Concerned about the information? Get in touch with us straight. Alternatively, email editorial-crew (at) simplywallst.com.

This report by Basically Wall St is basic in mother nature. We offer commentary based mostly on historical information and analyst forecasts only utilizing an impartial methodology and our content articles are not intended to be monetary tips. It does not represent a recommendation to purchase or sell any inventory, and does not take account of your objectives, or your financial situation. We intention to carry you extended-phrase concentrated investigation pushed by essential data. Take note that our examination may perhaps not variable in the most up-to-date price-delicate enterprise bulletins or qualitative materials. Only Wall St has no place in any shares stated.