ATI Physical Therapy, Inc.’s (NYSE:ATIP) 12{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} loss last week hit both individual investors who own 64{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} as well as institutions

To get a perception of who is definitely in manage of ATI Bodily Treatment, Inc. (NYSE:ATIP), it is vital to comprehend the possession construction of the company. We can see that personal fairness corporations very own the lion’s share in the firm with 64{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} ownership. Set yet another way, the team faces the utmost upside prospective (or downside chance).

Though institutions who have 24{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} arrived beneath tension after sector cap dropped to US$222m previous 7 days,private equity corporations took the most losses.

In the chart under, we zoom in on the various ownership groups of ATI Bodily Treatment.

What Does The Institutional Ownership Convey to Us About ATI Physical Therapy?

Lots of institutions measure their efficiency in opposition to an index that approximates the community current market. So they generally spend additional interest to firms that are bundled in important indices.

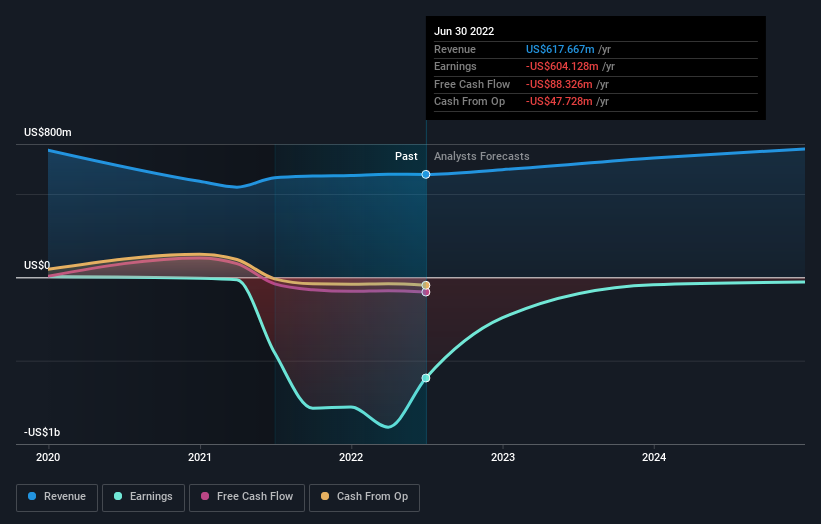

ATI Actual physical Therapy now has establishments on the share registry. In truth, they individual a respectable stake in the firm. This implies the analysts functioning for those people institutions have seemed at the stock and they like it. But just like everyone else, they could be erroneous. It is not unheard of to see a huge share selling price drop if two massive institutional buyers attempt to market out of a inventory at the exact time. So it is really worth checking the past earnings trajectory of ATI Physical Therapy, (down below). Of course, preserve in mind that there are other factors to take into consideration, much too.

ATI Actual physical Remedy is not owned by hedge cash. The firm’s largest shareholder is Arrival Intercontinental Corporation, with ownership of 56{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f}. This indicates that they have the greater part desire regulate of the long run of the enterprise. In comparison, the second and 3rd largest shareholders keep about 7.7{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} and 4.7{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} of the inventory.

Though studying institutional possession for a organization can incorporate price to your analysis, it is also a very good observe to research analyst suggestions to get a deeper realize of a stock’s envisioned effectiveness. Pretty a handful of analysts address the inventory, so you could search into forecast growth pretty quickly.

Insider Possession Of ATI Physical Therapy

When the exact definition of an insider can be subjective, just about everyone considers board customers to be insiders. The business administration respond to to the board and the latter really should depict the interests of shareholders. Notably, in some cases prime-degree professionals are on the board by themselves.

Most take into account insider possession a beneficial since it can indicate the board is effectively aligned with other shareholders. Nonetheless, on some occasions way too considerably electric power is concentrated in just this group.

Our most recent knowledge signifies that insiders individual considerably less than 1{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} of ATI Bodily Treatment, Inc.. It appears to be the board users have no a lot more than US$1.5m well worth of shares in the US$222m enterprise. Many investors in more compact organizations prefer to see the board a lot more heavily invested. You can click on right here to see if those people insiders have been shopping for or selling.

Common Public Possession

The basic public, who are typically individual traders, hold a 12{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} stake in ATI Physical Therapy. Whilst this team can’t always get in touch with the pictures, it can undoubtedly have a real affect on how the corporation is operate.

Private Equity Ownership

With an ownership of 64{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f}, non-public equity corporations are in a posture to engage in a function in shaping corporate strategy with a aim on worth generation. Some may like this, simply because non-public equity are sometimes activists who maintain administration accountable. But other moments, private fairness is selling out, having getting the corporation community.

Future Actions:

It really is normally truly worth thinking about the various teams who personal shares in a organization. But to understand ATI Physical Therapy better, we have to have to consider a lot of other factors. Be informed that ATI Bodily Remedy is exhibiting 4 warning indications in our expenditure investigation , and 1 of individuals is possibly critical…

In the end the long term is most vital. You can obtain this free report on analyst forecasts for the firm.

NB: Figures in this posting are calculated using facts from the past twelve months, which refer to the 12-month time period ending on the previous day of the thirty day period the monetary assertion is dated. This may well not be steady with complete yr annual report figures.

Have feedback on this post? Anxious about the content? Get in touch with us immediately. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This report by Basically Wall St is standard in mother nature. We give commentary based on historical info and analyst forecasts only applying an impartial methodology and our articles are not supposed to be economical information. It does not constitute a recommendation to invest in or sell any stock, and does not consider account of your targets, or your money problem. We intention to bring you long-time period concentrated assessment pushed by fundamental info. Take note that our examination might not element in the most recent cost-sensitive corporation bulletins or qualitative content. Simply just Wall St has no posture in any shares pointed out.

The views and thoughts expressed herein are the views and opinions of the writer and do not essentially mirror people of Nasdaq, Inc.