New Oriental Education & Technology (EDU): Chart Of The Day

Sushiman/iStock via Getty Images

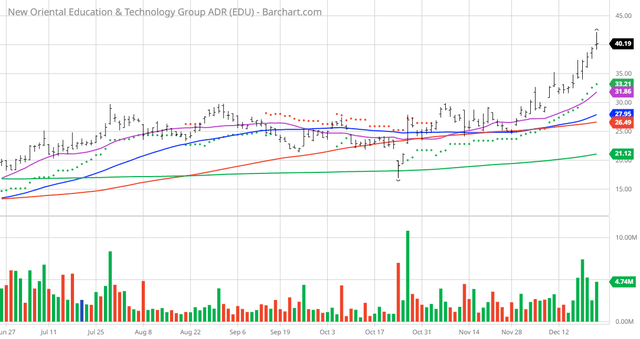

The Chart of the Day belongs to the Chinese education services provider New Oriental Education & Technology (EDU). I found the stock by using Barchart’s powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 11/3, the stock gained 50.87{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f}.

EDU Price vs 20, 50,100 DMA ( )

New Oriental Education & Technology Group Inc. provides private educational services under the New Oriental brand in the People’s Republic of China. The company operates through Educational Services and Test Preparation Courses; Online Education and Other Services; Overseas Study Consulting Services; and Others segments. It offers test preparation courses to students taking language and entrance exams used by educational institutions in the United States, the Commonwealth countries, and the People’s Republic of China. The company also provides non-academic tutoring courses; intelligent learning systems and devices to offer a digital learning experience for students; and overseas studies consulting services. In addition, it offers online education services through the Koolearn.com platform that provides comprehensive online education courses, including college educational services, such as college test preparation, overseas test preparation, and English language learning for college students and working professionals preparing for standardized tests or seeking to enhance their English language proficiency; and educational content packages to schools and institutional customers, including universities, public libraries, telecom operators, and online video streaming providers. Further, the company develops and edits educational materials for language training and test preparation. As of May 31, 2022, it offered educational programs, services, and products to students through a network of 107 schools; 637 learning centers; and nine bookstores, as well as through its online learning platforms. The company was founded in 1993 and is headquartered in Beijing, the People’s Republic of China.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} technical buy signals

- 106.56+Weighted Alpha

- 90.29{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} gain in the last year

- Trend Seeker buy signal

- Above its 20-, 50- and 100-day moving averages

- 12 new highs and up 53.22{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} in the last month

- Relative Strength Index 78.71{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f}

- Recently traded at $40.19 with 50-day moving average of $27.94

Fundamental Factors:

- Market Cap $6.69 billion

- Revenue expected to decrease 14.80{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} this year but up by 14.10{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} next year

- Earnings estimated to increase 119.00{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} this year, up an additional 57.30{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} next year and continue to compound again at an annual rate of 14.81{08cd930984ace14b54ef017cfb82c397b10f0f7d5e03e6413ad93bb8e636217f} for the next 5 years

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 8 strong buy, 15 buy and 1 hold opinion in place on this stock

- Analysts have price targets from $24.00 to $54.00 with an average of $37.05 which is down from its close today of $40.19

- The individual investors following the stock on Motley Fool voted 704 to 134 for the stock to beat the market with more experienced investors voting 108 to 31 for the same result

- 18,640 investors are monitoring this stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector – Consumer Discretionary

Industry – Education Services

Ranked Overall – 1007 out of 4768

Ranked in Sector – 122 out of 550

Ranked in Industry – 10 out of 29

Quant Ratings Beat The Market »